Key figures

FY2024 (31 December 2024), if not indicated otherwise.

Financial Guidance

The figures of the guidance 2025 as mentioned below were calculated on the same basis as the actual figures for 2024 and based on current rules and regulations.

2025 Revenue

€ 6.5-6.7bn

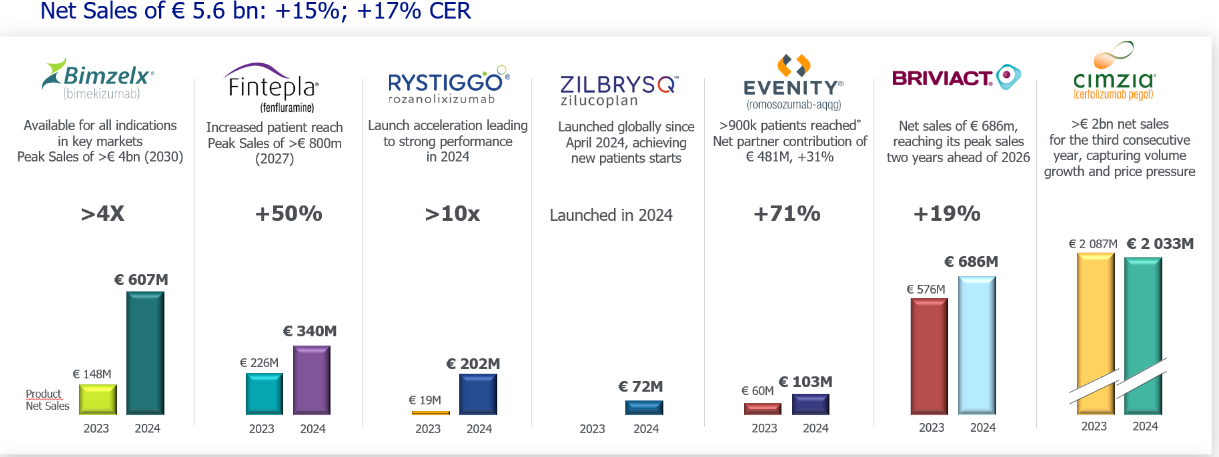

Strong growth driven by BIMZELX®, FINTEPLA®, RYSTIGGO®, ZILBRYSQ®, EVENITY®, BRIVIACT®, despite impact of 340B and IRA across portfolio.

CIMZIA® volume growth expected to be overcompensated by pricing pressure

2025 adj. EBITDA

30%

Continued gross margin improvement, operating leverage improvement, continued growth of marketing and sales expenses driven by top-line growth and relatively stable R&D expenses and continued EVENITY® earnings contribution

2025 Core EPS

€ 6.80 - 7.40

based on an average of 190 million shares outstanding

Product Sales

Strong underlying net sales growth thanks to a resilient product portfolio & new launches.

NAYZILAM® only available in the U.S., EVENITY® sales outside of Europe reported by Amgen and Astellas

BRIVIACT®

peak sales guidance

≥ € 600 million by 2026

achieved ahead of time in 2024

FINTEPLA®

peak sales guidance

≥ € 800 million by 2027

BIMZELX®

peak sales guidancet

> € 4 billion

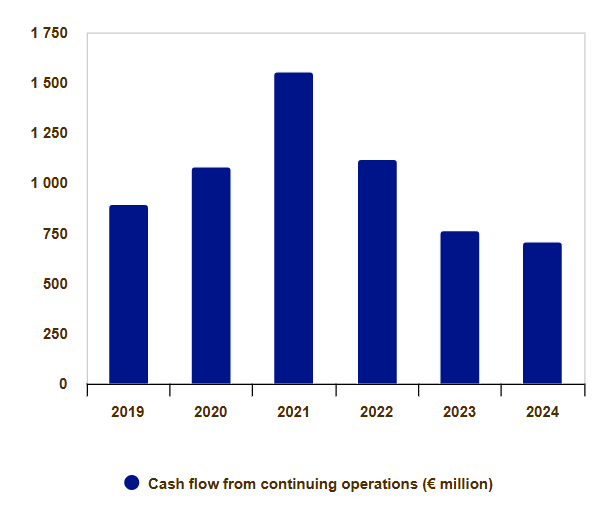

Cash Flows

In 2024, the evolution of cash flow generated by bio-pharmaceutical activities was affected by the following:

- Cash flow from operating activities amounted to € 1 242 million compared to € 761 million in 2023. The cash inflow stems from underlying net profitability and lower working capital mainly due to higher outstanding payables at year-end partially offset by an increase in inventories linked to the five product growth drivers and higher outstanding receivables reflecting the growing net sales.

- Cash flow from investing activities showed an inflow of € 282 million, compared to an outflow of € 440 million in 2023. The 2024 investing activities include mainly the proceeds (net of cash disposed) from the divestment of UCB’s mature neurology and allergy business in China for € 619 million offset by € 322 million capital expenditures and € 19 million equity investments mainly by UCB Ventures.

- Cash flow from financing activities had an outflow of € 818 million, which includes the full repayment of the bullet term loan facility agreement for the acquisition of Ra Pharmaceuticals, Inc. (US$ - 605 million) and the partial repayment of the bullet term loan facility agreement for the acquisition of Zogenix, Inc. (US$ - 200 million), the dividend paid to UCB shareholders (€ - 259 million), the acquisition of treasury shares (€ - 162 million) and interests paid (€ - 160 million) partially offset by the proceeds of the € 500 million senior unsecured bonds, issued under UCB’s EMTN program.